stock option exercise tax calculator

Calculate my AMT Reduce my AMT - ISO Planner Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022. The AMT adjustment is 1500 2500 box 4 multiplied by box 5 minus 1000 box 3 multiplied by box 5.

How Stock Options Are Taxed Carta

The tool will estimate how much tax youll pay plus your total return on your non.

. Your stock options cost 1000 100 share options x 10 grant price. The stock price is 50. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios.

When logging into your stock option portal you should have four options to choose from with your 100 stock options. Ad All the Trading Tools You Need to Quickly Place Your Trades into the Market. A non-qualified stock option NSO tax calculator estimates your gain in a hypothetical exercise scenario and computes the associated costs.

Use this calculator to determine the value of your stock options for the next one to twenty-five years. Regarding how to how to calculate cost basis for stock sale you calculate cost basis using the. In this situation you exercise your option to purchase the shares but you do not sell the shares.

Open an Account Now. Note that there is no tax implication. Stock option exit calculator See how much your stock could be worth See how much you might potentially bring home if your company IPOs or exits.

Answer Your basis in the stock depends on the type of plan that granted your stock option. If you decide to exercise when the stock price is 5 your theoretical gain is 4 per share. Exercise tax incidence arises only when an employee is granted ESOPs and they exercise these equity grants.

Get started Know your options. How much are your stock options worth. Ad Receive a free funding offer to cover all your option exercise costs including tax.

Ad Trade Cboe Mini Index options on Interactive Brokers professional platform. This calculator will help you decide which choice will likely maximize your after-tax profits. Ad For Private and Public Companies Who Want Equity Plans Done Right.

The number of shares acquired is listed in box 5. This information may help you analyze your financial needs. Lets say you are granted 10000 options with an exercise price of 1.

Ad Sign up for the latest on how to invest in Nasdaq-100 Index Options. It requires data such as. Diversify holdings mitigate your risk by spreading it across sectors and market caps.

How to calculate it. Purchase your shares of. The AMT is complicated and it depends on your income tax brackets etc.

On this page is a non-qualified stock option or NSO calculator. Fund all your stock option exercise expenses including tax - with no out-of-pocket costs. By changing any value in the following form fields calculated values are immediately.

When your stock options vest on January 1 you decide to exercise your shares. This permalink creates a unique url for this online calculator with your saved information. It is based on information and.

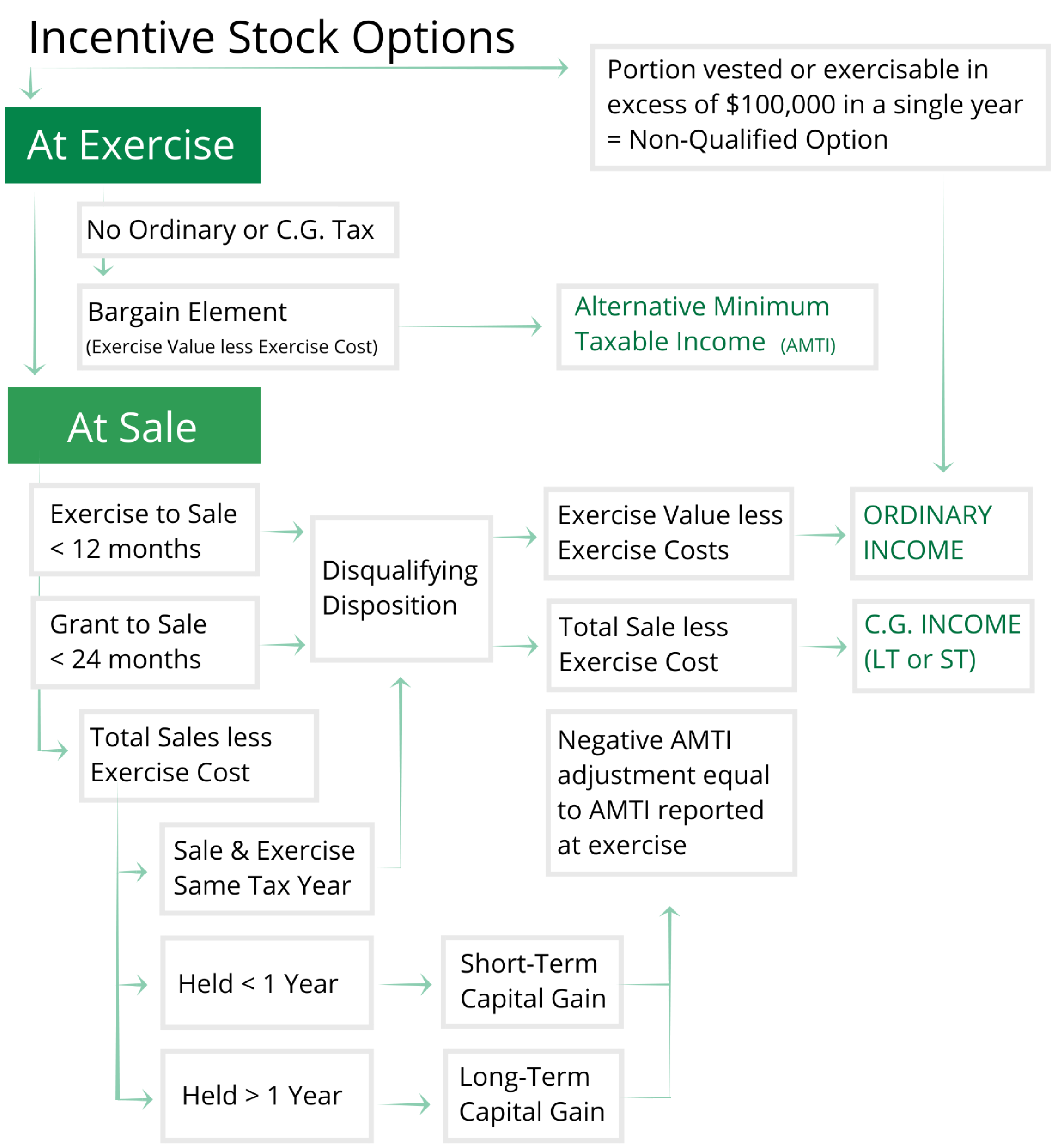

For every 1 beyond the phase out amount the exemption amount is reduced by 025. Incentive Stock Option - After exercising an ISO you should receive from your employer a Form 3921 Exercise of an Incentive Stock Option Under Section 422 b. You pay the stock.

For example a single person who has AMTI of 525000 will only have 72900 - 525000 -. On this page is an Incentive Stock Options or ISO calculator. If the current FMV is 5 your taxable income will be 5 minus 1 equaling 4 per share.

The Stock Option Plan specifies the total number of shares in the option pool. Ad A smarter way to execute your indexed annuity strategy. To make it as easy as possible weve built an online calculator that crunches the numbers for you and.

Your compensation element is the difference between the exercise price 25 and. Ad Receive a free funding offer to cover all your option exercise costs including tax. Gain access to the Nasdaq-100 Index at 1100th the notional value.

Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your. Fund all your stock option exercise expenses including tax - with no out-of-pocket costs. As the stock price grows higher than 1 your option payout increases.

Click to follow the link and save it to your Favorites so. The Stock Option Plan specifies the employees or class of employees eligible to receive options. Thus your taxes will be based on.

On this page is a non-qualified stock option or NSO calculator. Ad Learn What You Want When You Want. Non-Qualified Stock Option Calculator This calculator can be used to estimate the number of shares you may own after you do a cashless exercise net-exercise of non-qualified stock.

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

How Much Are My Options Worth Eso Fund

Secfi Decide When To Exercise Your Stock Options

When Should You Exercise Your Nonqualified Stock Options

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

The Ins Outs Of Stock Options In Moneytree Plan Moneytree Software

When To Exercise Stock Options

How Stock Options Are Taxed Carta

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

Tax Planning For Stock Options

Net Exercising Your Stock Options

How Stock Options Are Taxed Carta

Video Included What Is An Employee Stock Option Mystockoptions Com

Stock Options 101 The Essentials Mystockoptions Com

What Are The Holding Period Requirements Of An Iso Mystockoptions Com

The Ins Outs Of Stock Options In Moneytree Plan Moneytree Software